What is Private Equity / Venture Capital Fund?

PE / VC Fund Investors

Unlike Business Angels who invest their personal money, Venture Capitalists invest third party money. The money that Private Equity & Venture Capital firms invest comes from a variety of sources, including pension funds, sovereign wealth funds, insurance companies, fund of funds, endowment, foundations, corporations and family offices. PE & VC funds have the capacity to invest large sums through out the different stages of company's development. For example typical VC Fund size in Europe is €130m on average while PE funds are larger and depending on a strategy can be up to billion euros.PE / VC Fund Structure

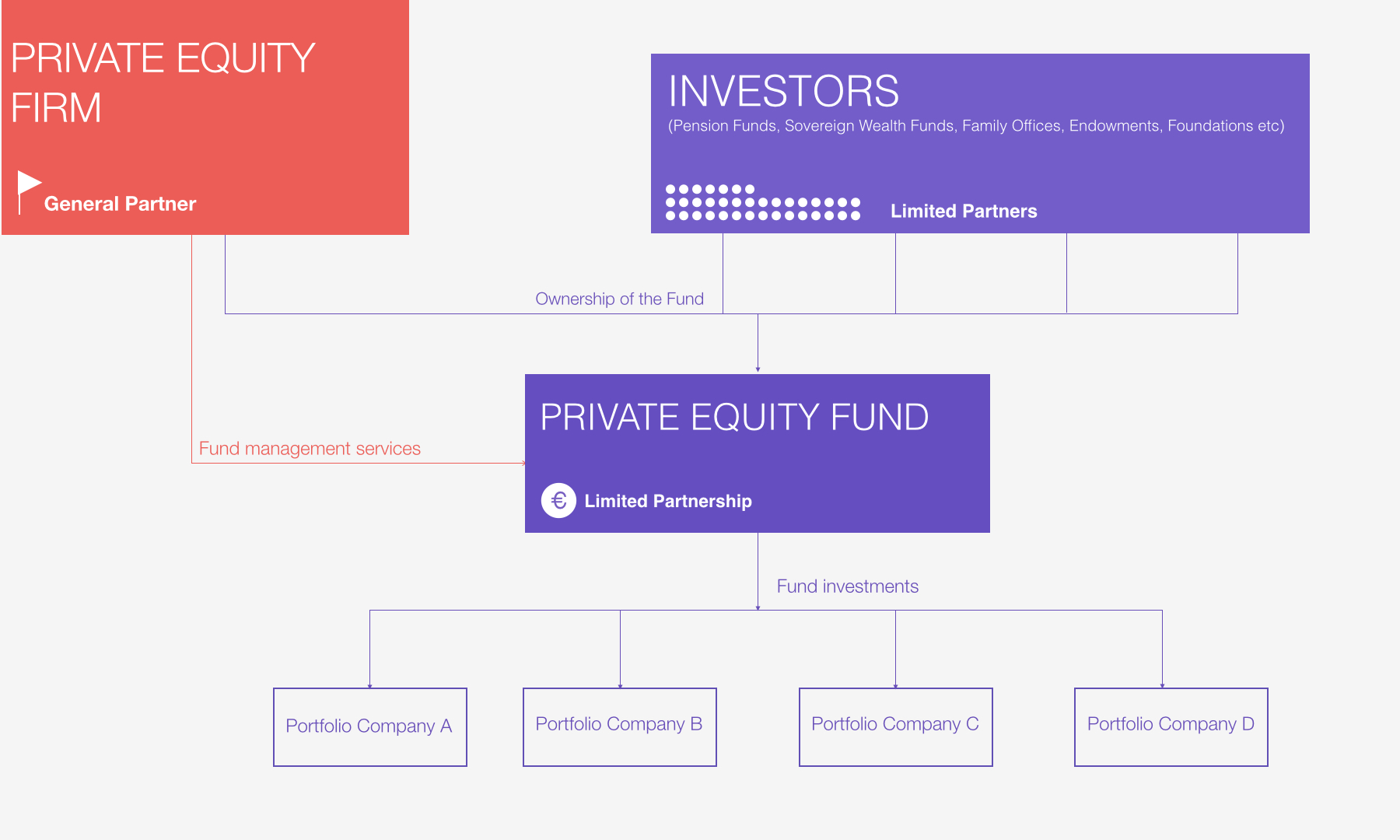

Those who invest money in Private Equity & Venture Capital funds are considered Limited Partners, while the Private Equity & Venture Capital Firms are the General Partners responsible for managing the investments and working with the portfolio companies. Fund itself is a Limited Partnership. General Partners also commit certain % of the fund size of their own money to align the interests with the investors.Fund Life Cycle

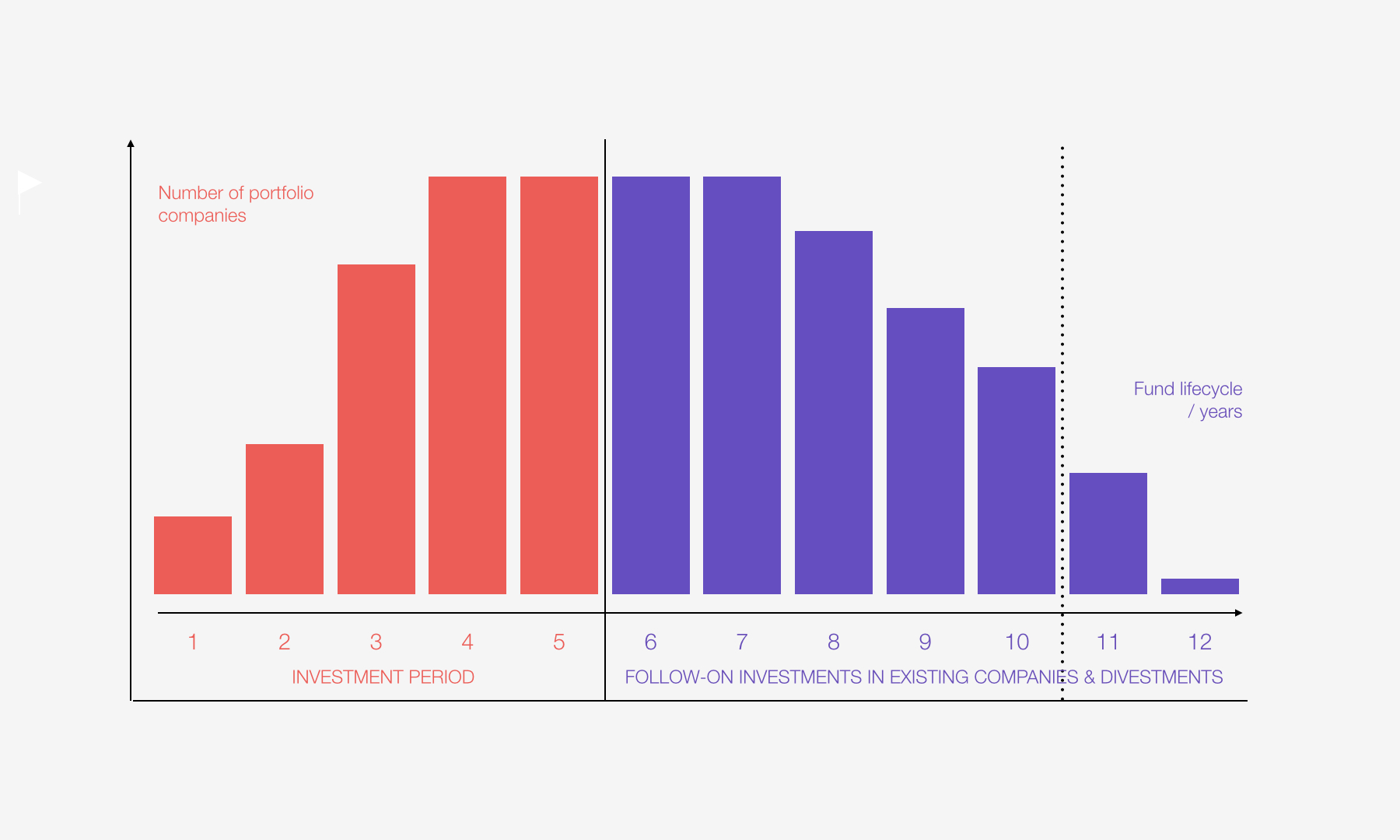

Fund life cycle is generally 10 years but can be prolonged up to 2 years. Typically during the first 5 years fund manager selects the investments and invests about half (depending on the strategy) of the committed capital into them. Its called the Investment Period. After the Investment period fund managers focus on existing portfolio companies and make follow-on investments with the remaining capital. By the end of the fund, fund managers need to sell the companies and return the money and profits to the investors.Fund managers work with the companies 5-10 years before the companies can be sold. As Fund managers expect high returns on their investments, they take a very active role on the companies.

Cover photo: Laurice Solomon